PRIVATE EQUITY FUNDING ADVISORY

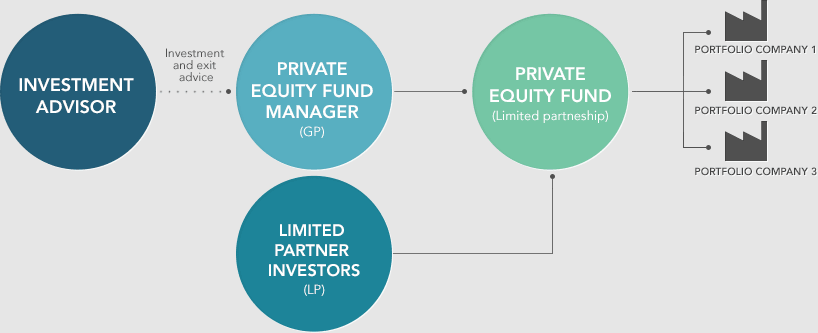

We provide assistance in the placement of Private Equity Capital / Long Term Debt / Preference Share Capital for suitable projects. Promoter funds are raised by placing equity with the private investors for a period of three to five years. The placement is done with or without premium depending on the financial strength of the company. An option for the promoters to buy-back the equity at the end of a predetermined period through the option of right of first refusal can also be structured into the deal. We leverage our deep entrepreneurial consulting experience to advise private equity and venture capital firms on potential investments and acquisitions.

We help private equity and venture capital investors identify, assess and screen potential investments into innovative and high growth companies. Additionally, we provide valuable strategic consulting services to portfolio companies in order to accelerate growth and maximize investors’ return on investment.

Our consulting services include:

- DUE DILIGENCE: We perform comprehensive due diligence services for the purpose of reviewing and investigating investment opportunities.

- BUSINESS PLANNING: We work closely with company management to develop actionable strategic business plans.

- FINANCIAL MODELING: We provide develop full financial projections for emerging businesses, including income statements, balance sheets, and cash flow statements.

- MARKET RESEARCH: We perform strategic market research to assess and validate market opportunities.

- MARKETING SERVICES: We create marketing plans, branding strategies, customer acquisition strategies, and implement integrated internet marketing consulting services to accelerate business growth.

- EXIT PLANNING: We assist portfolio companies with the development of realistic paths to liquidity events for company management and investors.